SAP Fiscal Year Variant, Posting Period Variant & Tolerance Group

- Vishwaraj Gujar

- Feb 20, 2021

- 5 min read

Updated: Jan 19, 2023

Fiscal Year Variant

What is a fiscal year?

It is a period of twelve months for which a company regularly creates financial statements and checks inventories. Under some business requirements the fiscal year may correspond exactly to the calendar year, but this is not obligatory. Under certain circumstances a fiscal year may be less than twelve months (shortened fiscal year).

In SAP the fiscal year is assigned as a variant. A fiscal year is divided into posting periods . Each posting period is defined by a start and a finish date. SAP allows a maximum of 16 posting periods in each fiscal year. It consists of 12 regular posting periods and 4 special periods which can be used for audit or tax adjustments to already closed periods. One fiscal year variant can be assigned to multiple company codes.

We have following options for defining fiscal year variants:

a. Fiscal year same as calendar year- Fiscal year starts from Jan to Dec. Here periods correspond to calendar months. Mostly used by US companies.

b. Fiscal year differs from calendar year (non-calendar fiscal year)- The posting periods can also be different to the calendar months. Below picture illustrates fiscal year from 1st April-31st March and is used by Indian companies.

Image reference - www.help.sap.com

c. Fiscal year is year-dependent. This means that the fiscal year only applies to a specific calendar year. For this in "OB29" while defining fiscal year variants select-Year dependent category. We also need to define end dates of periods and month limits for each calendar year.

How to create fiscal year variant.

Step 1. Go to T-code OB29

Step 2. Click Maintain Fiscal Year Variant>

Step 3. To create a new variant - Click on New Entries

Enter details:

FV - Insert two digit alpha-numeric fiscal year key.

Description - Enter description of variant.

Calendar Year - If fiscal year is same as calendar year , select this box.

Year-dependent - If start and end of fiscal year changes between year ,select this box.

Number of posting periods - 12, as 12 months of fiscal year.

No of Special posting periods - 4, for year end closing activities.

* Calendar year is not selected because Indian Financial year starts from April-March and not Jan- Dec as in US case.

*Year dependent is not selected because SAP System will ask for particular year for which the variant is being used, and will allow conversion for that particular year only. If this option is de-selected , means it will be applicable for all years.

After inserting the details click Save in the standard toolbar.

Step 4. Now double click 'Periods' from the dialogue structure. This is done to maintain periods of the fiscal year.

Insert the details as shown in picture. Here fiscal year starts from April 2020 and ends on March 2021. So the month of April is considered as Period 1 , and May as Period 2 and so on. Similarly January 2021 is Period 10 but with Year shift as -1, indicating a shift in year.

Step 5. Click Save > New FSV is created.

Assigning FSV to company code:-

Step 1. Enter T code OB37

Step 2. Enter the Company code ,which is to be assigned a variant. Also enter the Company name , the new Fiscal Year Variant created and the description as shown in below picture.

Step 3. Click Save. Thus, FSV is assigned to Company code.

Posting Period Variant

Posting periods are defined in fiscal year variants. This variant helps in maintaining open and close periods for posting entries. Usually, only the current posting period is open for posting, all other posting periods are closed. At the end of this posting period, the period is closed, and the next posting period is opened. PPV can be assigned to multiple company codes as per requirement.

Steps to create Posting Period Variant:-

Step 1. Enter T code OBBO

Step 2. You get the following screen. Click - New Entries

Step 3. You get the following screen.

Enter four digit code in the Variant field, update variant name in the name field. Click on Save. PPV is created.

Open and Close posting periods:

Step 1. Enter T code 'COFI' / 'OB52'

You get the following screen.

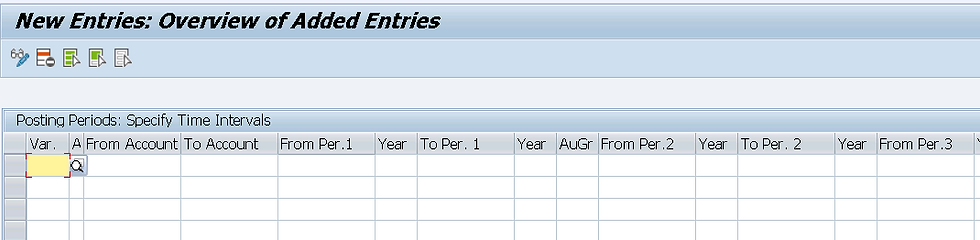

Step 2. Click on New Entries. You get the following screen

Enter details in the fields,

Variant- Enter 4 digit Posting period variant code which you created.

Select Account type -

3. From account- Keep blank

4. To account - For + acc type insert xxxxxxxx , but for other acc types you will need to insert account numbers.

5. From Period 1- Enter the period from where posting need to start. Eg 1 for April , 2 for May and so on. It ensure system is open to allow entries.

6. Year- Enter current fiscal year.

7. To Period - Enter the ending period. Eg 12 for March

8. Year - Enter Year

9. From Period 2 - Enter First Special Posting Period

10. Year - Enter Year

11. To Period - Enter Period where the Special Posting period ends.

12. Year - Enter Year

13. Authorization Group - It ensures only authorized persons can handle the postings.

After entering the details , Save them. Open and Closing Posting Periods are successfully defined and set.

Tolerance Groups

SAP Tolerance Groups authorizes users to make postings/entries according to set limit. They determine various amount limits for employees and predefine the maximum amount an employee is permitted to post, the maximum amount the employee can post as line items in a customer or a vendor account, the maximum cash discount percentage the employee can assign in a line item, and the maximum allowed tolerance for payment differences for the employee.

How to configure?

Step 1. Enter T code OBA3

Step 2. After you get the following screen , click New Entries

* Here Tolerance Group is not defined for many company code means all employees can post or make entries to that company code. But where TGs are assigned to company codes , they have limited authorization for posting entries.

Step 3. Enter details in the required fields.

Company code- Enter the company code for you are setting up authorization.

Currency- Enter the local currency.

Tolerance Group- Insert a 4 digit code , and adjacent to it enter its description.

Permitted Payment Differences- Update the payment differences of gain & loss with amount and percentage . (Eg Rev and Loss amount is 500 with 1% and adjusted discount is 100, this means the user can process the business transaction with the payment difference of 500 with gain or loss of 1 percentage. The SAP system doesn’t allow to process the transaction above the payment differences amount).

Payment Terms from Invoice- It indicates that the Terms Of Payment for the original item are to be used for residual items. (In this case, the amount qualifying for cash discount is specified in such a way that the relationship between the amount qualifying for cash discount and the line item amount of the original item is also given in the residual item).

After entering the details about customer and vendor tolerances> click Save.

Tolerance Groups are created.

Happy Learnings..

My LinkedIn link - www.linkedin.com/in/vishwaraj-gujar-a5a82110a

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

qiuqiu99

PAUTOTO

PAUTOTO

PAUTOTO

PAUTOTO

PAUTOTO

SUPTOGEL

SUPTOGEL

SUPTOGEL

SUPTOGEL

SUPTOGEL

BANTOGEL

BANTOGEL

BANTOGEL

BANTOGEL

BANTOGEL

GUATOGEL

GUATOGEL

GUATOGEL

GUATOGEL

GUATOGEL

LAMTOTO

LAMTOTO

LAMTOTO

LAMTOTO

LAMTOTO

SlotGacorGuide

SlotGacorGuide

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

situs qiuqiu99

BAN DAFTAR

BAN LOGIN

GUA LINK ALTERNATIF

LAM LINK ALTERNATIF

PAU LINK ALTERNATIF

RAP LINK ALTERNATIF

SUP LINK ALTERNATIF

LPG888 LINK ALTERNATIF

Berisi semua panduan SLot

Spin

Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel Slot Terbaik

Artikel…

Panduan Lengkap Cara Bermain Slot

Cara Bermain Slot Mahjong Ways

Cara Bermain Slot Starlight Princess

Rahasia Slot 5 Lions

Cara Bermain SPACEMAN

Cara Bermain The Great Icescape

Cara Bermain Sweet Bonanza

Strategi Jitu Bermain Lucky Neko

Cara Bermain Ways of the Qilin

Panduan Cara Menang Slot Online

Perbedaan Slot Pragmatic vs PG Soft

Cara Bermain Joker’s Jewels

Perbedaan Mahjong Ways PG Soft dan Mahjong Ways 3

Panduan Lengkap Cara Bermain Slot Wisdom of Athena 1000

Awal Mula Permainan Slot

Rahasia Cara Menang Main Slot Online

Cara Bermain Tembak Ikan KS Gaming

Cara Bermain Slot Fortune Rabbit

Rahasia Tips Bermain Wild Bandito

Perbedaan Slot Online dan Live Casino

Strategi Ampuh Bermain Sugar Rush

Misteri Kemenangan Besar di Bonanza Gold

Panduan Pola…